Your digital investment

assistant

analyst

partner

Your digital investment

assistant

analyst

partner

Benefits

Power

A free to use, market-leading application for your investment proposition

Control

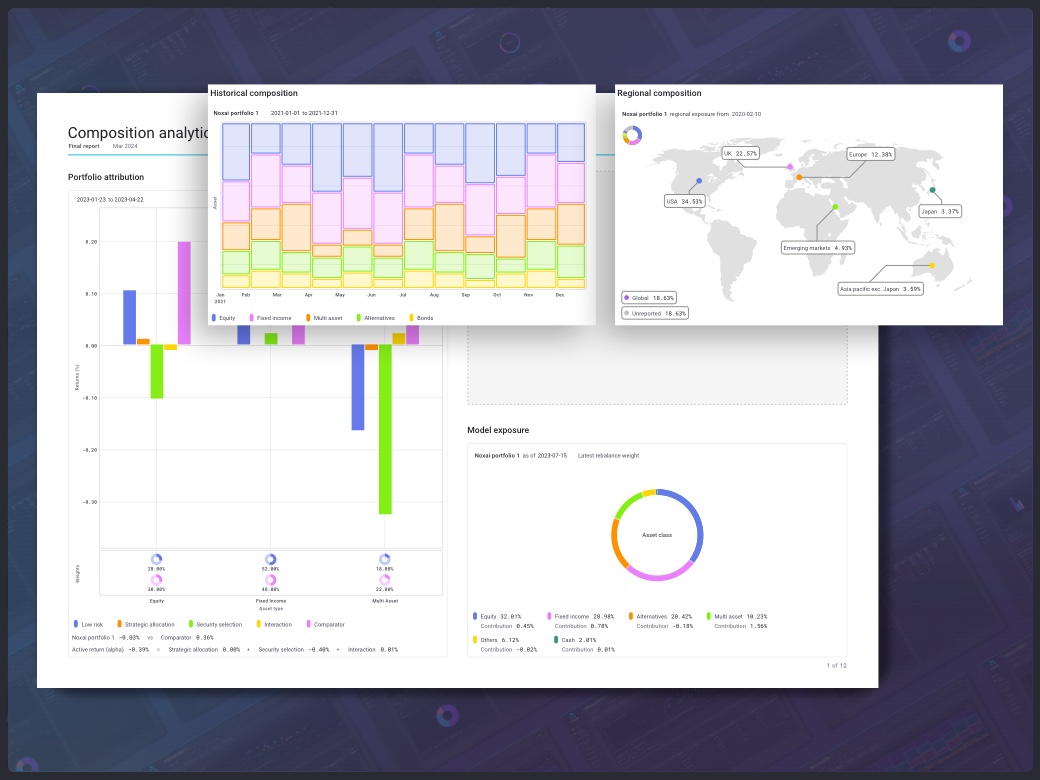

Build, manage and track all your portfolios under one roof

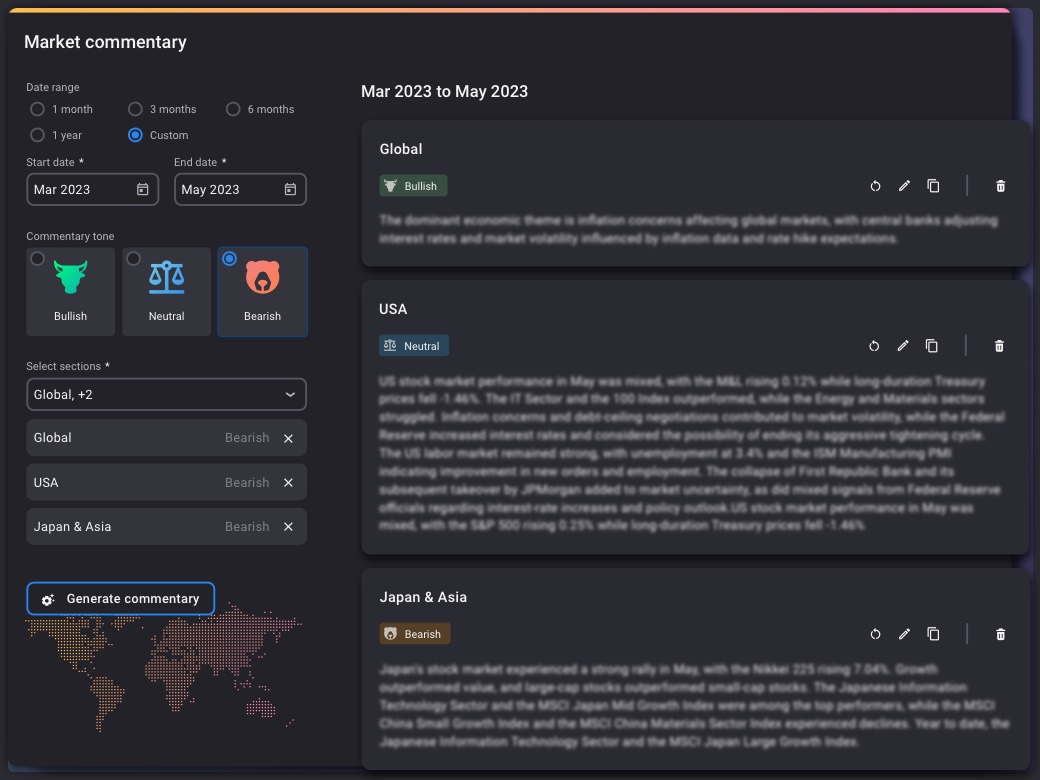

Smart Content

Automated commentaries and factsheets at the click of a button

24/7 Monitoring

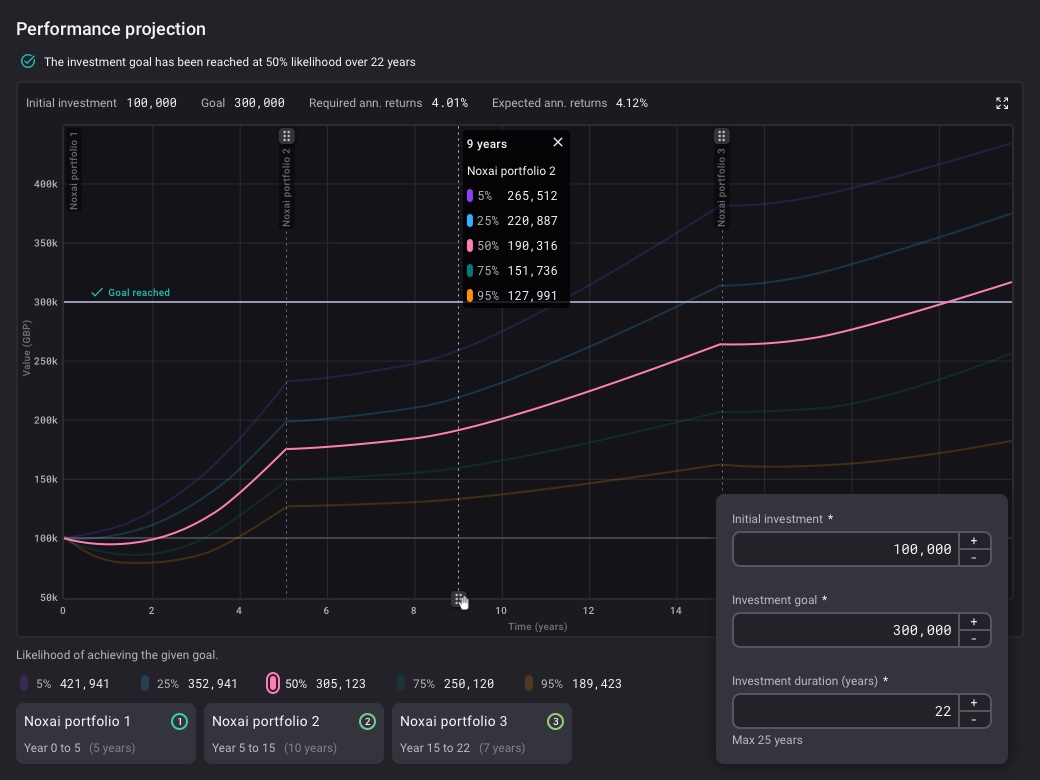

Live performance tracking and risk alerts so you won’t miss a thing

Intelligence

Health checks to help manage your portfolios, built with Consumer Duty in mind

Features

Access a suite of incredible tools

Noxai

Noxai

Intelligence for your portfolios

Will help save time, save money, improve client outcomes... and it's free.

Plans

Choose a plan that works for you

Free

Free

It's truly free to use!

£ 0

- Up to 3 users

- Up to 100 portfolios

- Unlimited portfolio ranges

- 100k+ Funds & ETFs, 55 IA benchmark instrument universe

- Up to 20 custom benchmarks

Features

- Smart generation market commentaries

- Portfolio health check

- Text and email alert notifications

- Interactive analytics tools

- Portfolio performance projections

- Custom portfolio factsheets

- Batch factsheet production

- Full report branding & custom disclaimers

- and much more

Premium

Premium

Starting at £140 and going as low as £90 per user/per month, based on the number of users

- Unlimited users

- Up to 300 portfolios

- Unlimited portfolio ranges

- 100k+ Funds & ETFs, 55 IA benchmark instrument universe

- Unlimited custom benchmarks

Features

- Everything in free

- Smart generation portfolio commentaries

- Portfolio and funds stress tests

- Scenario testing

- Fund health check

- Portfolio attribution

- Configurable health check alerting

- Additional user roles

- and much more

Say goodbye to spreadsheets and manual data entry.

Noxai lets you focus on what matters –

looking after your clients.