Why Putting Money in the Bank Might Make You Poorer Than You Think

It’s hard not to get caught up in seeing interest rates rise after being low for so long. No doubt for most of the last decade, there were times when you couldn’t imagine your bank paying any level of interest on the cash balance in your bank account.

With so much uncertainty in the world at times, while it might feel like a prudent decision to just keep your money tucked away in your bank earning some level of interest rather than fret about market returns, you may actually be impacting your future wealth.

After all, we all invest for a specific reason, to achieve our specific goals in life – whether that’s living a comfortable retirement or realising some other important aspects.

So, let’s assume, as an investor, that you can put your cash on deposit and match the current Bank of England (BoE) base rate. In reality, that’s easier said than done, but let’s be generous and assume that you can get a rate of 5.25% pa.

Now, to an investor, particularly a cautious one, that might sound attractive.

However, the first point to raise, and possibly the most important one, is that those rates are high for a reason. As you might know, inflation has been an important topic and factor these past few years. With inflation currently at 6.7%[1], a nominal 5.25% return on your cash only guarantees one thing – that in real terms (i.e. what you earn after inflation), you will lose money.

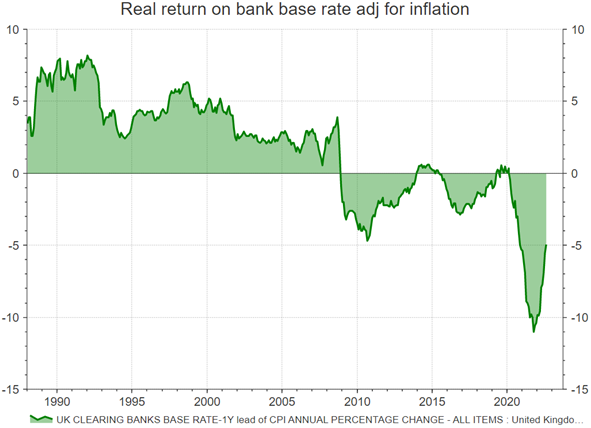

Of course, that was not always the case.

If we look back over the last 40 years, it was perfectly normal for interest rates to run higher than inflation, offering you a small positive real return. But that all changed with the Great Financial Crisis of 2008. Even with the rate rises that have taken place over the past 18 months, cash in the bank has delivered a negative real return on your money.

[1] UK Consumer Price Index YoY – August 2023

That being said, if you don’t consider all of the alternative investment choices, that nominal 5.25% return does sound enticing (assuming you can get it), doesn’t it?

Yet, if we take a long-term view of investing, say, at least 10 years, then equities (particularly global equities) would probably grow your wealth more.

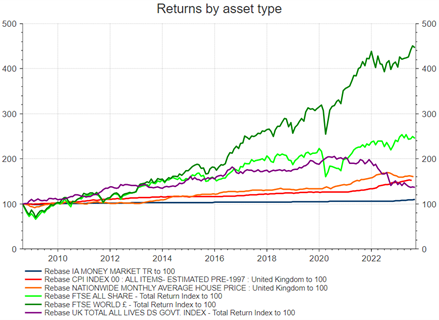

Let’s look at the last 15 years, which for equities means the Autumn of 2008 – hardly an auspicious time to select, just ahead of the Great Financial Crisis. We’ll start with a comparison of cash (money market), residential property, Gilts, UK and Global equites. Chart B reflects this analysis. The red line in this chart reflects inflation – the line we need to beat to provide a real return.

Even with such a difficult start to this timeframe, as the chart demonstrates, equities returned the most over this period.

Chart B

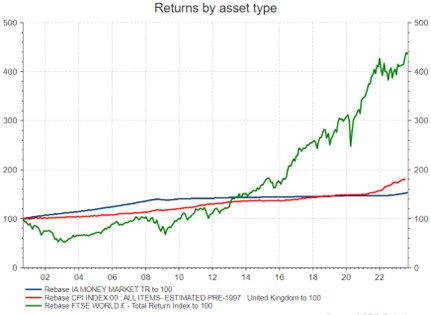

Chart C shows these same investment options, but over a shorter timeframe (5 years).

Chart C

Even if we were to take the worst possible starting point over the last 40 years (September 2020), equities have beaten cash or inflation. The key with all of this assessment, in terms of investing, is knowing and understanding what your risk tolerance and time horizon is (amongst a number of other important questions to ask yourself).

Chart D

What about those experts who always seem to claim to know when to be in, and then get out of, the market?

Often in the financial news, everyone seems to believe they can time the market. And I mean everyone – whether they’re private investors, professional investors, or my annoying cousin. For those with a medium to long term investment time horizon, the important decision isn’t really about trying to time the market but being in the market in the first place.

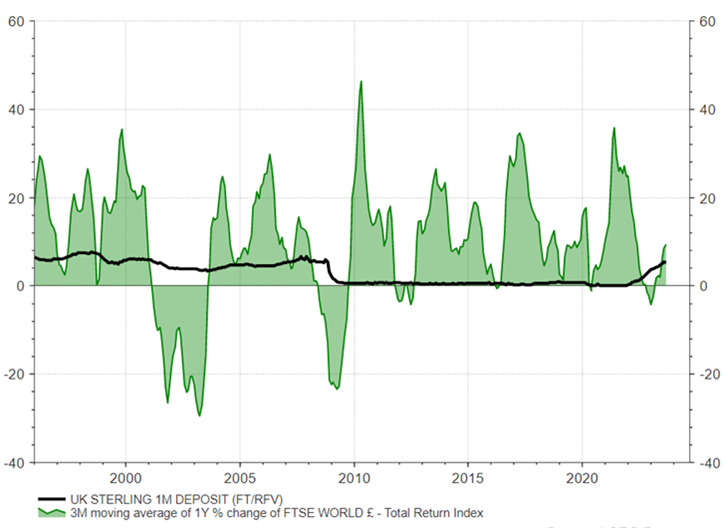

Let’s assume two more scenarios. Each represents a different investment choice you could have made over the last 27 years – 1) putting £100 a month in a bank account, or 2) regularly investing £100 a month in global equities. For the sake of simplicity, we will use a 3-month moving average to replicate the ‘market timing’ effect of regular contributions.

So how do those returns compare?

Well, if you look at Chart E, most of the time you’re better off going with regular investments into the market. Now, this simple comparision looks at actual annual returns, but one can easily surmise the cumulative effective of this apporach by reviewing the previous charts from before. Once again, investing, and remaining invested, offers you the benefits of growing your long-term wealth, and helping to reduce the effects of inflation.

Chart E

As we are often ‘required’ to disclose in financial articles of this nature, I would be remiss in omitting – ‘the value of investments and the income from them can go down as well as up, and past performance is not a guide to future performance’.

One can never assume that investing is a risk-free, guaranteed process. As mentioned, even the decision to leave your money in a bank account comes with consequences.

The point I’m trying to make is that sound investing decisions should invariably take into consideration all investment choices, and it’s important to understand what those choices mean, in terms of helping you achieve your goals and investment objectives.

Or, to put it more succinctly, and as the old industry proverb goes – ‘it’s time in the market that matters, not trying to time the market’.

https://www.collidr.com/app/uploads/2024/10/Collidr-Insights-Remaining-Invested-October-2023.pdf

Disclaimer: FOR PROFESSIONAL USE ONLY. This report was produced by Collidr Technologies Limited (“Collidr”). The information contained in this report is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment. While Collidr uses reasonable efforts to obtain information from sources which it believes to be reliable, Collidr makes no representation that the information or opinions contained in this report are accurate, reliable or complete. The information and opinions contained in this report are provided by Collidr for professional clients only and are subject to change without notice. You must in any event conduct your own due diligence and investigations rather than relying on any of the information in the report. Collidr Technologies Limited is registered in England and Wales No. 09061794. Registered office: 34 Southwark Bridge Road, London, SE1 9EU, UK