Any Dr Doolittle fans out there?

Of course, I’m referring to the classic 1967 film with Rex Harrison, not the 1998 abomination from Eddie Murphy, nor the not quite so awful 2020 version with Robert Downey Jr.

For fans of the film or the book you might remember the ‘Pushmi-Pullyu’ animal – a cross between a gazelle and unicorn, with two heads on opposite ends of its body. It was able to view two separate and, on occasion, contradictory sights at the same time.

Sometimes financial markets behave like this as well, take two quite contradictory views, using two conflicting sets of data, but often from the same information source and investment environment. Can someone actually have two apparently contradictory ideas at the same time? In the financial markets, it appears that, at times, you can.

With headlines about tariffs and Ukraine dominating the news, and the clear blue water between the ‘Trump’ view of the world and how it is perceived in Paris, Berlin, and London, it may seem difficult to reconcile with conflicting data about the health of the US economy.

Markets do not like uncertainty, but the one thing we can be certain about with Donald Trump’s presidency, or Trump 2.0, is that elevated level of uncertainty. Whether it’s US trade policies, tariffs, tackling government spending or Ukraine, nothing is certain, and everything, it appears, is up for grabs.

One week US policy can be heading in one direction, and then, a month, or even a week later, it’s pointing the other way. Tariffs are coming, no, they’re delayed, no, back on again. A world leader is a fool, no, he’s great, tremendous, hold on, he’s weak, an idiot, wait, we’ve got a deal, this guy is a real friend. Get the picture?

In terms of planning, it’s a bit of a nightmare for businesses. Nothing is really certain anymore. Yet, at the same time, businesses can be reasonably certain of the overall US business environment – that there will be less regulation, less red tape, and, hopefully, less taxes.

So, when monthly business surveys occur, it’s probably not surprising that there is uncertainty, but equally, optimism. Confusing? Naturally.

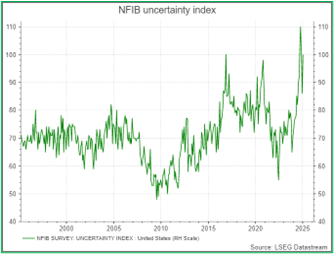

So, when the economic bears point out the surge in the uncertainty index, remember the surge in the optimism index as well. And if the bulls start highlighting the elevated business confidence, then it’s time to reference the extreme levels of uncertainty.

Except it’s not quite as clear as that, unfortunately. As the Great Financial Crisis unfolded, we all became pretty certain what was coming, we were certain that there was bad news on the way, hence the low score on the uncertainty index (as shown in Chart A2). In that sense, the uncertainty index is not a simple measure of good vs. bad.

Maybe we can forgive businesses for being confused, but what about the bond market?

We’ve all been told that the bond market is the biggest, deepest, most liquid financial market there is. For some, it’s the sum of all fears, the font of all knowledge, the oracle.

But what happens if the bond market is also confused, unclear, and prone to changing its mind?

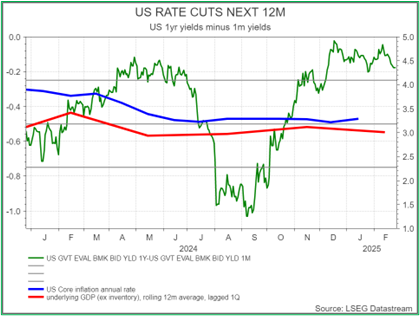

You can get a sense of what the US bond market is expecting, in terms of the interest rate outlook, by comparing the 1 year and 1-month yields. Over the last 15 months or so, there’s been a lot going on.

As Chart B below shows, rate cut expectations have been shifting around quite a bit. By January the market was pricing in around 60bps of cuts, then they melted away, before aggressively returning in the summer. So, by August the market was expecting up to 100bps of cuts.

Then, almost as quickly as they appeared, they went away. By the end of February 2025, the market was almost back to where it started.

Except, actually, very little has changed. One head of the Pushmi-Pullyu was seeing this huge volatility and rotation in the bond market, while the other head… well… not so much.

Back to that bond market chart. If one head was stressing over inflation or growth, what was the other head seeing?

Actually, not a lot. To date, we haven’t seen the meaningful reduction in inflation that the bond market had been expecting since the start of 2024 (the blue line in Chart C). When Japanese equities sold off significantly in the summer last year, we didn’t get a meaningful slowdown in the economy that the bond market had been looking for either.

Inflation turned out to be sticky in a ‘3%+’ kind of way. The underlying growth in the US economy has also been remarkably consistent. The hopes and fears that the bond market keeps pricing in at times, has not come to pass.

So, even before the chaos that Trump brings to the global economy (which may be good or bad), we’ve had a rather confusing time of uncertain markets and more certain data trends.

The former seem set to continue, but the latter? That’s less clear.

It’s what the former US secretary of defence, Donald Rumsfeld, once referred to as moments where there are ‘… known knowns, things we know that we know; and there are known unknowns, things that we know we don’t know. But there are also unknown unknowns, things we do not know we don’t know.”

I couldn’t say it any better.

https://www.collidr.com/app/uploads/2025/03/Collidr-Insights-Market-Uncertainty-March-2025.pdf

Disclaimer: FOR PROFESSIONAL USE ONLY. This report was produced by Collidr Technologies Limited (“Collidr”). The information contained in this report is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment. While Collidr uses reasonable efforts to obtain information from sources which it believes to be reliable, Collidr makes no representation that the information or opinions contained in this report are accurate, reliable or complete. The information and opinions contained in this report are provided by Collidr for professional clients only and are subject to change without notice. You must in any event conduct your own due diligence and investigations rather than relying on any of the information in the report. Collidr Technologies Limited is registered in England and Wales No. 09061794. Registered office: Adler House, 35 36 Eagle Street, London, WC1R 4AQ, UK