As investment professionals, we’re no strangers to change. The financial landscape is constantly evolving, and as stewards of our clients’ wealth, it’s our responsibility to stay ahead of the curve.

What are the benefits of AI adoption

So what exactly does the future hold for AI in the financial advice realm?

Well, imagine having a personal financial adviser who is available practically 24/7, always has information at their fingertips and ready with a response, and can crunch numbers with the speed of a gazelle on Red Bull. Sounds impressive, right? With AI, this futuristic vision is becoming a reality.

Financial advisers who embrace AI-powered business models will rule the industry going forward, and are, in a way, already beginning to make waves in the industry.

These advisers will have access to virtual ‘digital assistants’, who will:

- Use algorithms to analyse data

- Dynamically assess risk tolerance

- Help design and monitor customised investment portfolios that align with the client’s financial goals

No more lengthy time spent pouring over data and preparing spreadsheets – just a few clicks on a sleek interface, and voila! It’s like having access to a supercharged financial adviser, ready to serve up investment advice, whenever and wherever you need it.

But it’s not just about the convenience factor. AI has the potential to democratise financial advice and make it accessible to a wider audience. Anyone with financial goals or specific needs, who isn’t sure how to best meet them, can benefit from these AI-powered advisers.

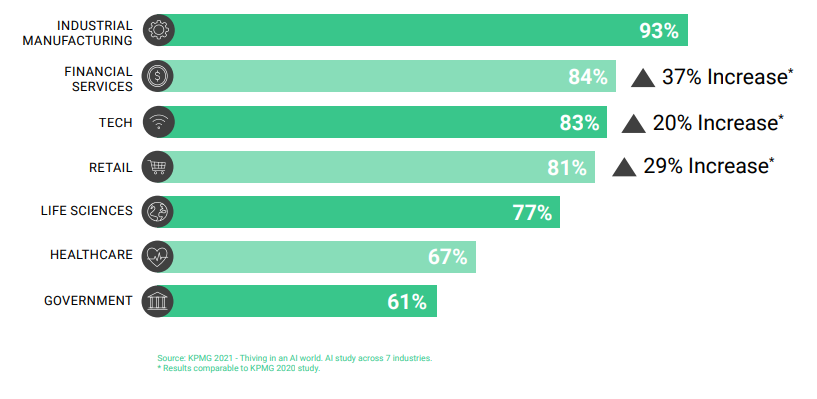

Rate of AI adoption has skyrocketed

Business leaders and government decision-makers say AI is at least moderately to fully functional in the organisation.

So, what forms of AI-powered financial advice can these firms offer?

Let’s explore some possibilities:

- Chatbot Companions: Imagine this – a friendly chatbot that engages in witty banter while helping you navigate your financial decisions. It could ask questions about your financial goals, risk tolerance, and investment preferences in a conversational manner. With its clever wordplay and cheeky sense of humour, it could make financial planning a delightful experience, rather than a daunting task. All overseen and pre-customised by the efforts of the adviser.

- Improved Customised Recommendations: AI can leverage vast amounts of data to provide tailored investment recommendations. By analysing factors like income, expenses, savings, and investment horizon, an AI-powered adviser could fine-tune the personalised investment plans that achieves a client’s unique background and objectives.

- Behavioural Finance Insights: Behavioural Finance Insights: We often are driven by emotions when it comes to money matters. But AI can step in to act as the voice of reason, providing objective insights based on behavioural finance principles. It can help identify human biases, spot potential patterns of poor decision-making, and offer objective advice that can help clients make more informed investment decisions. Say goodbye to impulsive “buy high, sell low” moves!

- Portfolio Monitoring: AI can keep a continual eye on investment portfolios, monitoring market trends, and making adjustments, in real-time. It can analyse market data, news, and economic indicators to provide proactive alerts and recommendations. It’s like having a financial watchdog that never sleeps, guarding your investments with unwavering vigilance.

- Financial Education: AI can also play the role of a financial educator, guiding clients on various aspects of personal finance. From explaining complex investment concepts in simple terms, to providing educational content and resources, AI can empower clients to make informed financial decisions.

Financial advisers who embrace AI-powered business models will rule the industry going forward, and are, in a way, already

beginning to make waves in the industry.

Nothing to fear

Of course, as with any technological advancement, there are concerns about the impact of AI on the job market and, for advice firms, support staff.

But fear not, for AI is not here to replace us, but rather to augment our abilities, and give us the means to scale up financial advice cost effectively.

While AI can provide efficient and personalised investment advice, it cannot replace the human touch that comes with empathy, intuition, and experience. In fact, the integration of AI in the financial advice industry can free up advisers from routine tasks, allowing them to focus on building deeper relationships with clients, understanding their unique needs, and providing holistic financial planning.

It’s a win-win situation where humans and machines work hand-in-hand to deliver the best outcomes for clients.

So, what does all of this mean for the future of finance?

Well, it’s an exciting time to be in the industry. As AI continues to evolve and reshape the financial advice landscape, we need to adapt and embrace the possibilities it brings. With AI-powered chatbot companions, improved customised recommendations, behavioural finance insights and portfolio monitoring, the way we deliver financial advice is set to undergo a revolutionary transformation.

Disclaimer: FOR PROFESSIONAL USE ONLY. This report was produced by Collidr Technologies Limited (“Collidr”). The information contained in this report is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment. While Collidr uses reasonable efforts to obtain information from sources which it believes to be reliable, Collidr makes no representation that the information or opinions contained in this report are accurate, reliable or complete. The information and opinions contained in this report are provided by Collidr for professional clients only and are subject to change without notice. You must in any event conduct your own due diligence and investigations rather than relying on any of the information in the report. Collidr Technologies Limited is registered in England and Wales No. 09061794. Registered office: 34 Southwark Bridge Road, London, SE1 9EU, UK