Keep me searching for a heart of gold

Humans have been fascinated with gold since the dawn of our time, with the first recorded gold artifacts, discovered in Bulgaria, dating from 4,600 BC. It’s been the inspiration for so many aspects in our lives, from jewellery to the arts, with my personal favourites being the 1948 film ‘The Treasure of the Sierra Madre’, and the Neil Young lyric I used for this article’s title.

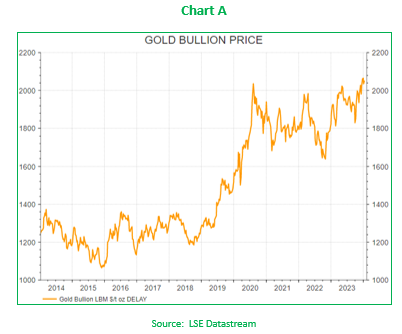

For investors, it has often been the ultimate store of value, as well as the uncorrelated asset of choice when the black swans are in flight. This is despite what the crypto enthusiasts might tell us. In recent years, we have seen a rally in the price of gold, both as a store of value in times of crisis (2020), and as a hedge against the corrosive effects of inflation (2023).

As it stands, gold supply has reduced in recent years, with production peaking in 2018. At the same time, central banks have significantly increased their purchases, particularly during 2022. Several nations, including China and Japan, have low levels of gold as a percentage of their reserves compared to other economies. The huge explosion in global debt levels, particularly in the USA, has generated further interest in gold as a store of value and as a possible source of diversification, to a possible issuance-led run on US treasuries.

For investors, gaining exposure to physical gold is not always straightforward, despite Costco’s recent efforts and whatever the proponents of several ETFs might claim. Indeed, even those funds (which claim gold bullion exposure) are usually only able to provide a limited underlying direct exposure to the ‘yellow metal’.

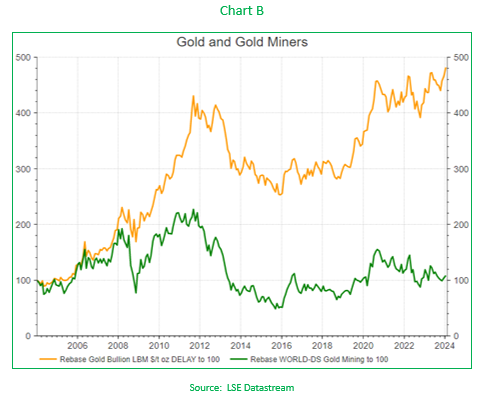

For practical reasons, gold exposure is often more easily achieved, indirectly, by investing in the equities of gold ‘miners’. The challenge, unfortunately, is that the ‘Gold and Gold Miners’ sector or sub-sectors of the market can have very different performance drivers, and radically different returns, from gold itself.

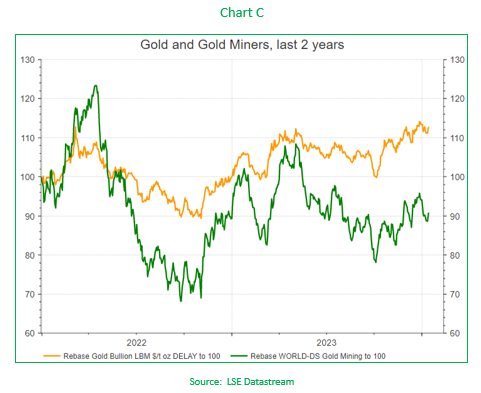

Over the last 20 years, the two have followed very different paths (Chart B), with the last two years seeing the gold miners sector lag the rally in the physical price of gold (Chart C).

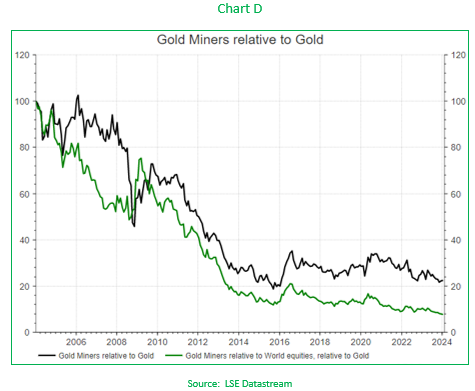

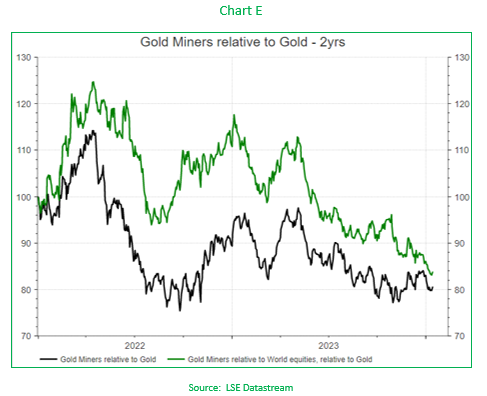

This underperformance becomes even more apparent when you look at a ‘price relative chart’, one that shows the relative performance of the gold mining sector to gold, and the relative performance of the sector relative to global equites (which is then compared to gold). Over both a shorter and longer-term time period (shown in Charts D and E respectively), gold miners have become disconnected from the price of gold.

The 24 carat question is, if you’ll pardon that pun, could this period of underperformance finally be coming to an end?

To start, one driver of this belief is the possibility for increased dividend payouts from this sector. For most of the last 20 years, gold miners have yielded less than global equities. However, stronger balance sheets and higher dividend payout rates mean that gold miners now yield more than global equites, 2.9% verses 2.3%, on average.

Another factor is the operating margin recovery throughout this sector. At times, analysing margins can feel like a rather opaque process, but it is clear that margins came under pressure during 2022, as cost inflation ripped through the industry as a consequence of Covid re-openings and the war in Ukraine.

Mining Production Costs

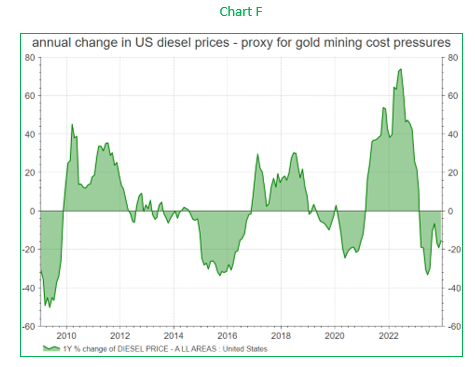

We can use US diesel prices as a proxy for mining production costs (i.e. transportation, lubrication oils, etc). During 2022 a combination of surging commodity prices and fears over a potential diesel shortage saw diesel prices surge, and this contributed to significant margin pressure for miners.

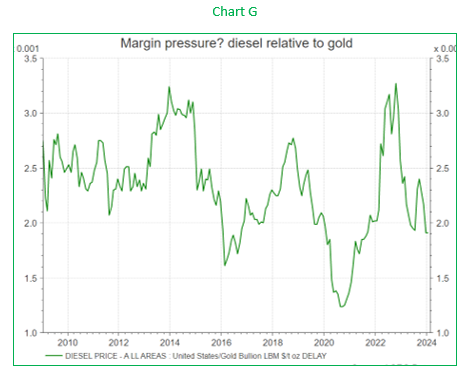

But with diesel prices falling (year-on-year), and higher gold prices, are margins finally set to recover?

Chart F and Chart G help to illustrate this point. Chart F shows that diesel prices are now in negative territory year-on-year, which is a completely different perspective to the ‘eye watering’ levels of 2022. Chart G compares diesel prices to gold – the lower the line in the chart, the better the outlook for gold miners’ margins.

These factors point to margin recovery and that should mean enhanced cash generation, which, with stronger sector balance sheets, may also lead to stronger dividend payments for shareholders.

In what we expect to be an uncertain outlook for 2024, with central bank policy decisions on interest rates, continued high levels of Government debt issuance and to a number of elections across the globe, we would recommend a balanced approach to portfolio construction, in which there is a strong case to consider gold as a source of diversification, and for gold miners to be a good option in which to benefit from that.

https://www.collidr.com/app/uploads/2024/08/Collidr-Insights-Gold-Stocks-February-2024.pdf

Disclaimer: FOR PROFESSIONAL USE ONLY. This report was produced by Collidr Technologies Limited (“Collidr”). The information contained in this report is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment. While Collidr uses reasonable efforts to obtain information from sources which it believes to be reliable, Collidr makes no representation that the information or opinions contained in this report are accurate, reliable or complete. The information and opinions contained in this report are provided by Collidr for professional clients only and are subject to change without notice. You must in any event conduct your own due diligence and investigations rather than relying on any of the information in the report. Collidr Technologies Limited is registered in England and Wales No. 09061794. Registered office: 34 Southwark Bridge Road, London, SE1 9EU, UK