It’s difficult to believe that we are now a quarter of the way through the century. It’s been 25 years since the Millennium, the so-called “Millennium Bug” and “dot-com” bubble. A lot has changed over the last quarter of a century but some things feel vaguely familiar.

The market is focused on the impact of a technology revolution still, leading to suggestions that this part of the market may be over-valued. Over the last two years, equity markets have become excited about the future prospects of earnings gains from the development and utilisation of AI technology. The technology sector now dominates the S&P500 Index, and US equities have had two years of over 20% gains.

Human behaviour is such that it’s easy to get swept up in market exuberance. Indeed, “herding behaviour”, where individuals act collectively as a group, is a major concern of behavioural analysis in markets. At Collidr, we prefer to use the array of tools at our disposal to monitor the current market environment, rather than attempt to predict future outcomes. This allows us to cut through any speculative noise and understand where the market is currently at, rather than suggesting that we know what’s going to happen in the future. The tools allow our analysis to adapt to changes in the market, typically when new information comes to light.

As such, the market is going into the new year following on from two years of strong equity returns (particularly from US equities). Bonds, generally, had a positive 2024, especially over the second half of last year. We see opportunities as the year progresses but also see major themes that investors should address, which may make 2025 a more volatile year than we have seen recently.

- President Trump has signalled there will be an increase in tariffs in goods from other countries. Is this likely to keep the threat of inflation high, as well as risk a global trade war?

- Developed economies have increasingly higher levels of debt and higher yields to contend with.

- Central banks may be hesitant to reduce interest rates further if an inflationary environment remains.

- If interest rates remain high, what impact will that have on the economy, and could it lead to a recession?

- How will geopolitical events, such as the war in Ukraine and various conflicts in the middle east, impact markets?

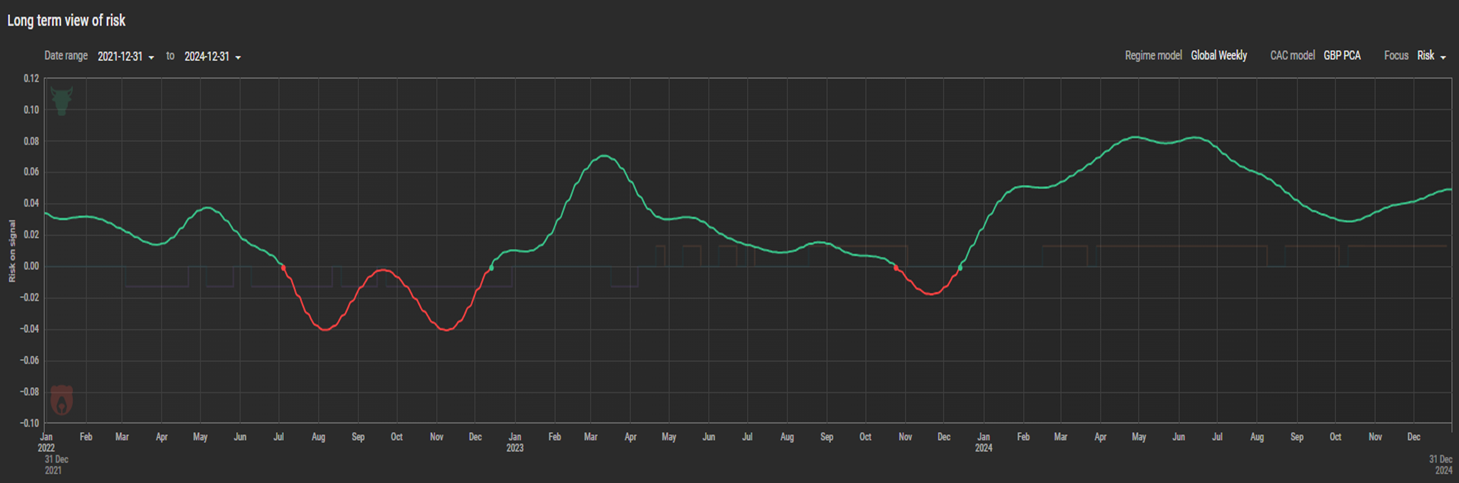

Firstly, one of the tools we use helps evaluate the longer-term view of risk from a high level, top-down approach (Chart A). This tool remained in bullish territory for the whole of 2024, suggesting that the prevailing market sentiment in markets would be a positive one. While this signal started to tail off at the back end of last year, it remained in positive territory for the year.

To start 2025, we maintain a positive mind-set, but are increasingly concerned of possible feasible inflection points. Particularly, we are concerned about the possibility of an increased inflationary period, as markets have been positioning for a number of interest rate cuts in 2025. We expect volatility to remain elevated during the year, so anticipate a bumpy journey.

However we believe that risk levels should be maintained, managing through short-term noise in the markets, while remaining vigilant to the risks that possible inflection points may bring.

Going into 2024 we have a positive mind-set but remain wary of some feasible inflection points, a few possible escalation events, for example, which may move the markets into a more defensive stance. We expect volatility to remain elevated during the year, so anticipate a bumpy journey ahead. However, looking through the short-term noise in the markets, we believe that risk levels should be maintained, while remaining vigilant to the risks that these possible inflection points may bring.

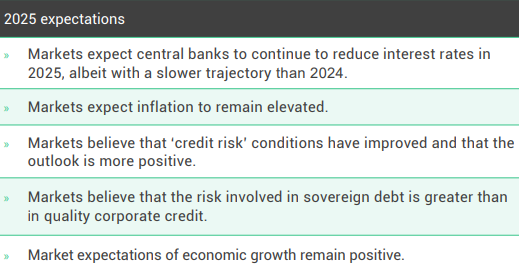

Secondly, we use macro economic quadrants to assist in analysing the current market condition set, including the asset classes most appropriate for these type of conditions. Charts B and C (below) reflect this analysis.

Given the reduction in interest rates by the US Federal Reserve (“the Fed”) in 2024, and the signalling that there is likely to be some further reduction in 2025, we remain in a “Loosening Monetary Policy” environment using this analysis. We also remain in an “Improving Credit Risk Appetite” environment, reflecting the positivity in the quality part of the credit space. Despite a move intra-year in the “Lower Inflationary” environment as inflationary expectations reduced, the signals ended the year in a “Higher Inflationary” environment, as well as a “Higher Growth expectations” environment. This analysis is purely data driven, so it reflects the current market conditions rather than any subjective view.

Moving this into a more practical context:

- Central banks loosened monetary conditions in 2024 as inflationary conditions seemed to ease. However, towards the end of the year, inflation figures remained elevated, especially in the US and UK.

- President Trump’s policy proposals (so far) are likely to be inflationary, which could create tensions between the legislature and the central bank. It remains to be seen how many of these policies will be implemented fully, and any likely impact, but the direction is clear.

- The US remains the driver of the global economy and the global stock market. Valuations (especially in US technology stocks) are at elevated levels on prospective AI earnings growth. Therefore, earnings announcements will be of particular importance in 2025.

- The risk of increased protectionism and global trade war remains elevated. Trump has made a number of policy pledges prior to taking office that may be watered down upon implementation, but risk to the economic growth of China and Europe has increased still.

- Developed economies have increased debt burdens following Covid and the Global Financial Crisis etc. Alongside increasing debt, yields are also at high levels (partly because of Quantitative Tightening (QT) measures) which is increasing demands on many countries’ fiscal budgets. As a result, bond ‘vigilantes’ are on the march, and sovereigns and corporates will need to pay attention.

- Economic data remains robust, especially in the US. However, cracks are beginning to appear with increased corporate defaults, which may increase should yields remain elevated. Employment data remains strong, although some countries, e.g. the UK, have an economic growth problem. Any signs of an economic slowdown must be watched closely.

- Geopolitical issues are still evident. While some commentators think that a Trump administration may help to resolve the war in Ukraine and the crisis in Gaza, the rhetoric has definitely moved to being more insular, with the risk of increasing geopolitical issues in the longer term.

ASSET CLASSES

So what does this mean for the different asset classes and strategies available to investors?

EQUITIES

Overall:

- US equities dominated returns in 2024. Given the strength of the US economy, and with President Trump’s policies likely to promote American interests first, and the US stock market having such a large exposure to the technology sector (which is expected to benefit from AI developments), market expectations are that this momentum in US equities and economy may continue into 2025.

- However, the US is already a large part of global equity indices (over 70% of the MSCI World Index), and it is likely that having a large exposure to the US is a common and crowded trade. In addition, the expectation is that new policy proposals from the White House are likely to be inflationary, which may keep yields elevated, creating a headwind for US companies, especially given the high valuations in the technology sector. This does create opportunities for sectors, such as commodity or inflation sensitive sectors, that may benefit from an elevated inflationary environment.

- Other geographic regions may face challenges ahead, not least of which is the suggested imposition of trade tariffs from the Trump administration. Europe’s economy is struggling, the UK faces high borrowing costs and a continued growth problem, Emerging Markets may have to deal with a stronger dollar, while China will continue to face headwinds from 2024 that are likely to continue into this year.

- On the other hand, should the US economy start to struggle in a higher yield environment, then higher US deficits could become an issue, leading to lower growth, higher financing rates and possibly a weaker dollar, which may benefit other parts of the market.

Currencies:

- The currency market is expected to be volatile this year. The market is already reacting to policy proposals and economic data, in terms of the expected interest rate changes over the next year. For example, at one point, the market expected the Fed to make seven rate cuts in 2025. It now appears to expect just one. The change in these expectations will increase currency volatility which, in turn, will impact portfolio returns, unless currency exposure is controlled or hedged.

Investment Approach:

- Therefore, the question remains – where to invest? A balanced approach seems optimal at this juncture. The new Trump policies are still proposals at this time. The last Trump Presidency consisted of many policies being suggested only to be revised or reversed before implementation. While there are concerns about the high valuations of the technology sector, there is no guarantee that these valuations are incorrect, if the resultant earnings continue to back them up. Therefore, the real challenge is to find the inflection point that will cause a market reversal.

- We expect to retain a substantial allocation to the US, where economic growth is expected to dominate, but ensuring there is a balance within that exposure – between growth, value, sector, and capitalisation biases. Outside the US, we think a balanced exposure between different geographic regions, maintaining allocations to assets that are likely to benefit from inflationary environments, such as commodities, is prudent. We remain vigilant to developing market conditions and economic data.

FIXED INCOME

Fixed income recovered somewhat in 2024, after a difficult couple of years. However, correlation between equities and fixed income remains at elevated levels, so the search for diversification remains. Towards the end of 2024, yields started to pick up as the markets started to come to terms with the possibility of inflation moving back to ‘higher-for-longer’. We see pockets of optimism in the fixed income space.

Government Bonds:

- In the Sovereign space, we see some risks ahead. Increasing levels of debt in developed economies has raised yields, putting fiscal decisions under pressure, and perhaps raising the concern of tensions between the legislature and central banks. Quantitative Tightening measures may also provide a headwind to Sovereign debt.

Corporate Bonds:

- In the investment grade space, we continue to see opportunities in debt issued by ‘quality names’, for example, strong established companies with substantial and stable cash flows. If there is economic stress in the system, quality names should continue to repay their debt, so there will be reduced default risk. Even though credit spreads remain at tight levels, quality corporate credit is preferable to Sovereigns due to having better balance sheets. For even more protection, look at the short-duration section of the market.

Money Market:

- With yields increasing, money market funds should continue to provide a decent yield for low volatility, whilst being mindful of the other risks present in this sub asset class.

High Yield:

- The high yield space continues to perform well, particularly with short duration. So maintain exposure here particularly in quality high yield names at the shorter end of the curve to reduce duration and default risk.

Investment Approach:

- We expect volatility to remain elevated in the fixed income market over the course of the year. However, we believe that there are parts of the fixed income market that would allow investors to capture upside opportunities, where they exist, but also have appropriate levels of protection, where possible. We prefer quality credit over sovereigns, shorter duration over longer duration, with some exposure to high yield and emerging market debt, for better risk adjusted returns.

OTHER ASSET CLASSES

As correlations between equities and fixed income remain elevated, alternatives and commodities continue to help improve portfolio diversification. We expect these asset classes to continue to provide diversification benefits in 2025, adding improved risk and return sources, as well as the potential to perform should conditions deteriorate.

Given that risks remain as conditions evolve, we continue to see alternatives as a way to help stabilise returns in a correction or highly-volatile environment.

- CTAs – In situations where volatility remains elevated, we think that Commodity Trading Advisor (CTAs) or trend following funds are a useful tool, as they add low to negative correlation to the main asset classes. Although position sizing becomes important, so that CTA’s do not dominate returns.

- Long/short equity and bond funds – These funds, run by good managers, can help provide positive/low volatile returns in these type of market environments, adding positive performance and limiting downside volatility.

- Commodities – If an inflationary environment persists, commodities can provide some protection and additional diversification.

- Currencies – Finally, there may be opportunities in currency markets, especially as we expect an increase in currency volatility. In this type of environment, there may be opportunities for currency strategies. In addition, there will be look-through benefits to other asset classes, such as emerging markets, should the US dollar weaken against other major currencies.

Disclaimer

The information contained in this document is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment, and examples used are for illustrative purposes only. This document provides commentary and data on global markets and does not provide any reference to specific products and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment in any jurisdiction. While all reasonable efforts are made to obtain information from sources which are accurate at the date of production no representation is made or warranty provided that the information or any opinions contained in this document are accurate, reliable or complete. The information and any opinions contained in this document are based on current market conditions and certain assumptions and are subject to change without notice. Any user must, in any event, conduct their own independent due diligence and investigations, together with their professional advisers, into legal, regulatory, tax, credit and accounting matters before making any investment, rather than relying on any of the information in the document. The value of investments and the income from them can go down as well as up and past performance is not a guide to future performance. This document is issued by Collidr Asset Management Ltd which is authorised and regulated by the Financial Conduct Authority (713361) and is registered in England and Wales. Company No. 09061794. Registered office: 35-36 Eagle Street, London, WC1R 4AQ, UK.

Sources: Collidr, Bloomberg. Indices: Barclays, FTSE, Bloomberg, STOXX, Japan Exchange Group, MSCI, S&P, New York Mercantile Exchange, Chicago Mercantile Exchange, Bureau of Labour Statistics, US and Office for National Statistics, UK.