Picture this:

You’re sitting in your office, sipping your morning coffee, and your phone buzzes with a notification. It’s your AI assistant, reminding you that it’s time to review your client’s portfolio and suggesting a few tweaks based on the latest market trends. You smile, knowing that your trusty AI sidekick has your back, and you can focus on what you do best – building relationships and providing top-notch financial advice.

Sounds like a dream, right?

Well, buckle up, because the AI revolution is here, and it’s about to change the financial advice industry for the better. To help you decide for yourself, we’ll explore how AI will impact the financial advice industry, and how it will, we believe, help advisers better serve their clients.

Let’s face it, the world of finance can be a complex and confusing place.

For many people, navigating the maze of investments, savings, and insurance products can feel like trying to find a needle in a haystack, or attempting to read an encyclopaedia. Not to mention the myriad of tax rules and investment products can seem overwhelming at times. That’s where financial advisers come in – to help clients make sense of it all and find the best solutions for their unique needs.

But what if there was a way to make your job easier?

Enter AI.

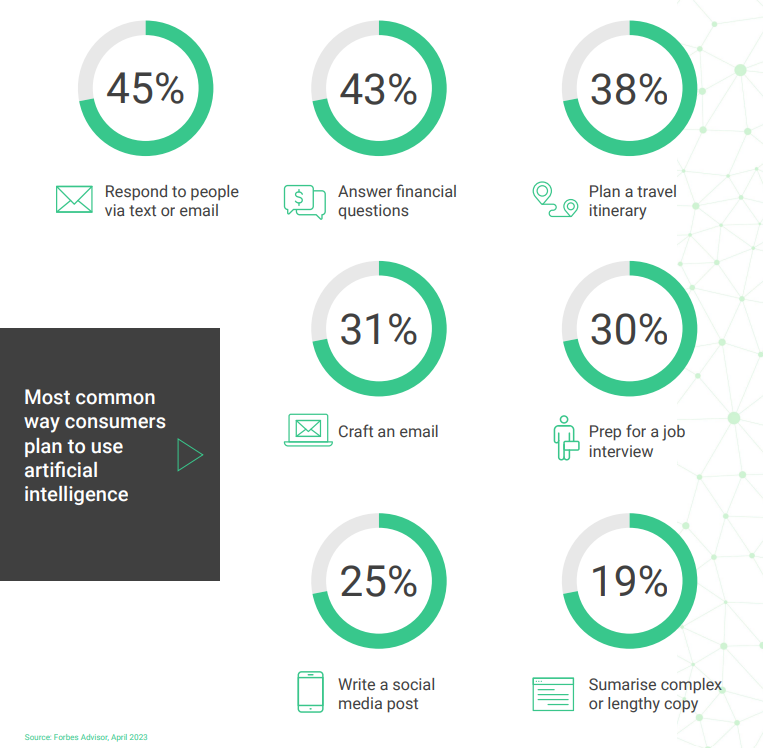

These digital ‘assistants’ can help you provide the very best of your desired, and customised, ‘customer service’, powering your ability to deliver on your clients’ financial goals or specific financial needs. And the best part? They’re here to make you more productive and automate many of the tasks which are often considered to be ‘mundane’.

A few ways AI can make a financial adviser’s life a whole lot easier.

- Data Analysis: As a financial adviser, you know that data is king. But with so much information out there, it can be tough to manage at times and transform into real decision-making intelligence. That’s where AI comes in. It can quickly and efficiently analyse vast amounts of data, helping you to identify trends, spot opportunities, and make better-informed decisions for your clients. For instance, you can create your own analysis and notifications on specific aspects of your client portfolios – from interest rate changes, cash planning assumptions, to fund rating updates – to allow you to get in front of any potential client questions or concerns. Essentially, it has the power to turbocharge your access to and use of data.

- Personalised Advice: Every client is unique, and their financial needs and goals can vary widely. Not only can AI help you achieve your objectives of creating personalised financial plans for each of your clients (a critical part of the recent Consumer Duty initiatives), taking into account their individual circumstances, risk tolerance, and objectives, but it can help you accomplish this in an effortless, automated way – providing much needed scale and productivity to your efforts. This means you can provide more tailored advice, while helping you to reach even more clients, to help them achieve their financial goals.

- Time Management: As a financial adviser, your time is precious. AI can help you to manage your workload more efficiently, by automating routine tasks and freeing up more time for you to focus on what really matters – building relationships with your clients and providing expert advice. For example, AI can assist in the area of maintaining strong and regular client engagement by automating client communications in a personalised and timely manner. Using natural language processing (NLP) capabilities, AI-powered ‘assistants’ can engage in conversations with clients, addressing their queries, and sending reminders for important events, all under your guidance and supervision. Furthermore, AI can leverage client data and use behavioural insights to tailor communication strategies more effectively.

- Continuous Learning: In the ever-evolving landscape of finance, AI-powered financial advisers will be able to seamlessly blend advanced technology with personalized insights, to revolutionize the client experience. These ‘systems’, with their sophisticated algorithms, can offer invaluable assistance by suggesting when portfolios should be reviewed, diligently monitoring risk thresholds and conducting an array of portfolio health-checks. These checks might measure behaviour, perform stress-tests, and scrutinize weight drifts and volatility at both individual security and portfolio levels. These adviser-lead, AI-driven systems will be able to generate tailored insights, allowing for investment decisions that are as unique as each client’s situation.

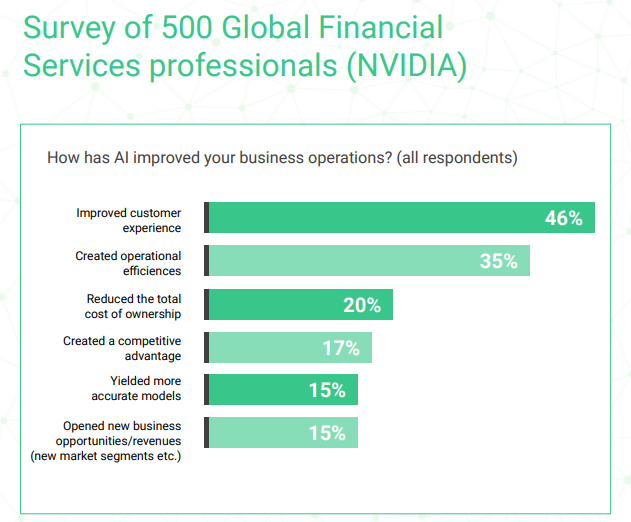

- Managing Your Business: Don’t forgot the overall benefits to you of including AI in your business processes, possibly linking the entire adviser ecosystem together – back office, platform, portfolio management, accounting – so that you are more efficient at assessing market and business risks, and creating operational efficiencies in your business, which could allow you to reduce expenses and pass these cost savings on to your clients. One of the properties that sets these systems apart is their ability to continually learn and adapt, ensuring that advisers are always equipped with the most current information, to make the best-informed decisions.

The Future of AI-powered Financial Advice: A Match Made in Heaven

So, what does the future hold for financial advisers and AI? We believe that the rise of AI-powered advisers will lead to a new era of financial advice, allowing advisers to truly leverage the full power and potential of machines. With each playing to their strengths – financial advisers guiding and counselling the client, and machines ensuring every technical, data-driven, number-crunching, and repetitive element, is delivered flawlessly and evolves as required.

AI will take care of the heavy lifting when it comes to data analysis, while advisers will continue to excel in areas like relationship building, empathy, and understanding the nuances of human behaviour. In other words, AI will be to you what Robin is to Batman, the Watson to your Sherlock Holmes, the Chewbacca to your Han Solo.

The rise of AI presents an exciting opportunity for financial advisers to enhance their services and better serve their clients. By embracing this new technology and working with AI, you can stay ahead of the curve and ensure that you continue to provide the best possible advice for your clients.

To that end, the next time you find yourself drowning in data, or struggling to keep up with the latest market trends, just remember: AI is here to help. And who knows, you might even find yourself with a little extra time to enjoy that morning coffee.

Disclaimer: FOR PROFESSIONAL USE ONLY. This report was produced by Collidr Technologies Limited (“Collidr”). The information contained in this report is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment. While Collidr uses reasonable efforts to obtain information from sources which it believes to be reliable, Collidr makes no representation that the information or opinions contained in this report are accurate, reliable or complete. The information and opinions contained in this report are provided by Collidr for professional clients only and are subject to change without notice. You must in any event conduct your own due diligence and investigations rather than relying on any of the information in the report. Collidr Technologies Limited is registered in England and Wales No. 09061794. Registered office: 34 Southwark Bridge Road, London, SE1 9EU, UK